Integration of the Wallet cryptocurrency wallet into the Telegram messenger in the fall of 2023 marked the starting point for the popularization of the TON blockchain and the growth of network activity. This is facilitated by the constantly expanding partnerships between projects—users gain new opportunities, such as purchasing usernames in NFT format. However, many believe that the key driver of growth is the gaming mini-apps that have laid the foundation for social gaming within this ecosystem.

The Incrypted team explored why gaming applications on Telegram are so popular among users, how they are connected to the TON blockchain, and whether they can truly help attract the next 500 million users to Web3.

What is Social Gaming?

Social gaming refers to a category of gaming projects accessible through social platforms and messaging apps. For example, representatives of this category include Diamond Dash on Facebook or poker games on Discord.

Typically, these are browser-based games embedded within the social network interface. Their key distinction is the expansion of the audience through the player’s contact base. Simply put, social games achieve expansion by having users publicly showcase their results and invite friends for joint play and additional rewards.

In Telegram, social gaming began to spread in the fall of 2023, following the integration of mini-apps that allow third-party services to be launched directly within the client. A unique feature of such games in the messenger is their connection to Web3, expressed, for instance, through the presence of tokens, use of NFTs, and support for transactions in TON.

It is widely believed that such projects can serve as a tool for attracting new users to the crypto industry, as they offer a simple and user-friendly interface for interacting with digital assets, and the audience of successful applications in this category numbers in the tens of millions.

Popular Gaming Applications on Telegram

The potential to leverage social gaming for the development of Web3 is primarily due to the close interconnection between the blockchain and the messenger. For example, mini-apps within the TON ecosystem can gain priority access to Telegram’s advertising platform, assistance in fundraising through Tonstarter, and eligibility for grant programs. Among these, The Open League can be highlighted as an example.

These preferences are not exclusively aimed at gaming applications; however, at the time of writing, they attract the most users on Telegram, thus having a high chance of receiving grants and ecosystem support. Below, we will look at some of the most popular social gaming projects within the TON ecosystem.

Notcoin

Notcoin is the most popular Web3 game on Telegram, launched in early 2024. The app is a classic “clicker” that allows players to earn rewards for tapping the screen. The gameplay includes additional elements such as boosters, rewards for attracting new users, and the creation of their own “squads.”

In May 2024, Notcoin launched its token, NOT, converting user points into digital assets on the TON blockchain. Following this, the team slightly modified the format of the gaming activity. On June 9, 2024, the developers announced that the project had reached 40 million registered accounts, becoming one of the largest mini-apps on Telegram.

It is noteworthy that Notcoin’s initial success is also linked to its “memetic” appeal. The project emerged during the rise of meme coins with inverse tickers like ANALOS, which contributed to its perception as an inverse version of the TON token.

Catizen

Catizen emerged as the winner of the fourth season of The Open League initiative, aimed at encouraging mini-app developers. According to the team, in June 2024, the project attracted nearly 10 million Telegram users, reaching 250,000 UAW. However, it’s important to mention that Pavel Durov reported 26 million Catizen users on July 24.

A key feature of the project is its more diverse gameplay compared to other “clickers,” alongside a development team experienced in creating applications for WeChat and Android devices.

Like Notcoin, Catizen utilizes the Play-to-Airdrop concept, with a future token launch in mind, but players can already earn NFTs and in-game assets.

YesCoin

YesCoin offers a gaming project in the style of Notcoin, replacing the “clicker” mechanic with a “swipe” mechanic—users must swipe across the screen to collect in-game points called YES. In other respects, YesCoin partially or fully mirrors the concept of its predecessor, including boosters, a referral program, and plans for a token launch.

Despite the absence of original mechanics, YesCoin managed to secure second place in the fourth season of The Open League, attracting nearly 15 million users and 141,000 UAW.

In addition to the ones mentioned, there are dozens of other gaming mini-apps, many of which are connected to the TON blockchain in one way or another. These can be found in the built-in marketplace introduced in the client update on July 31, 2024.

This update also allows multiple applications to be opened simultaneously and adds an embedded browser in Telegram that supports Web3 pages to provide deeper integration with the blockchain and enhance the user experience.

What is the reason for the success of Telegram games?

Unlike most other social platforms, gaming applications in Telegram can utilize both traditional and Web3 tools to expand their audience, creating a cumulative effect. Thus, messenger users are attracted by:

- Incentivization and the expectation of rewards. Many gaming projects, following the example of Notcoin, employ a Play-to-Airdrop strategy with an explicit or implicit promise to convert in-game assets into tradable tokens. This creates a system of incentives that is typically absent in traditional games.

- Social components. Leaderboards, referral links, “teams,” “villages,” and other elements of social interaction within the app enhance user engagement and foster a sense of competition. In the case of Web3 gaming, this factor is amplified by real financial rewards.

- Simple gameplay. Most mini-applications in Telegram use straightforward and easy-to-understand game mechanics. They require minimal effort from users, offering “recreational” gaming, and are relatively inexpensive to implement.

- Accessibility of applications. Telegram boasts over 950 million users, the majority of whom can launch their favorite game at any moment directly in the mobile or desktop client of the messenger. There is no need to download anything or create new accounts—simply opening the app is enough.

As the audience becomes more engaged in the Web3 ecosystem and more user-friendly tools for interacting with digital assets emerge, there will be an increased demand for other mini-applications related to blockchain, such as decentralized exchanges or lending protocols. An example is the Ton Gas Pump service for launching meme coins, which managed to attract 225,000 unique wallets in less than two months of operation.

However, it is currently the gaming projects that provide the broadest reach due to their simplicity and accessibility for users unfamiliar with the crypto industry.

The impact of gaming applications on Telegram and the TON ecosystem

The coordinated support of blockchain-based mini-applications by Telegram and the TON ecosystem may be linked to their positive influence on both projects.

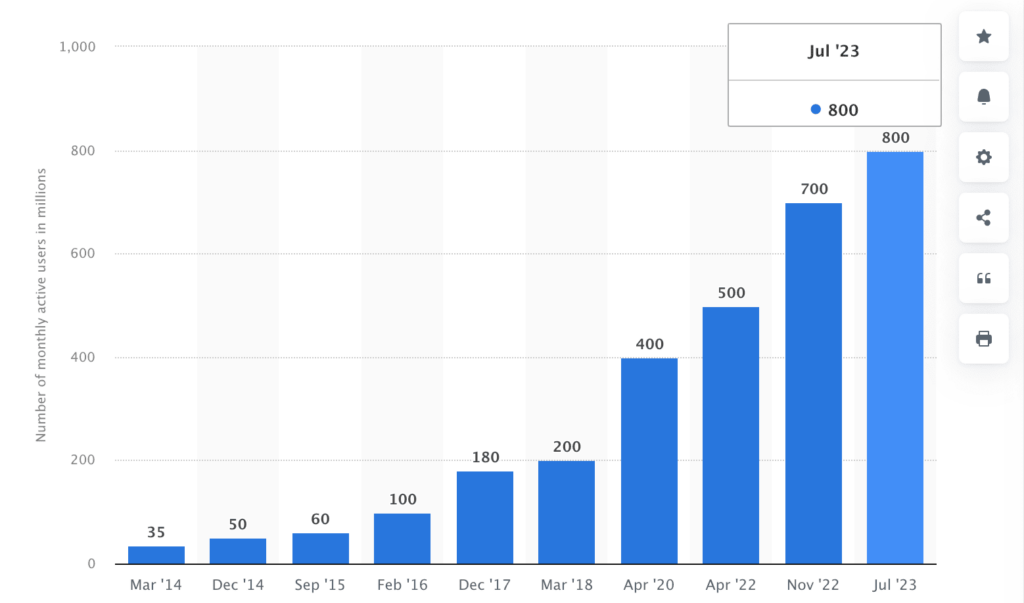

On July 22, 2024, Pavel Durov announced that the number of monthly active users (MAU) on Telegram reached 950 million, an increase of 50 million compared to the “spring.” At the same time, according to Statista, the MAU figure was 800 million in June 2023. This means that Telegram managed to attract 150 million active users over the year, with 50 million of those in June and July 2024.

This does not imply a direct correlation between the popularization of mini-apps and the growth of the messenger’s audience—over the past year, Telegram has introduced several other innovations, such as channel monetization, which have contributed to increased user activity. However, these events occurred within the same timeframe.

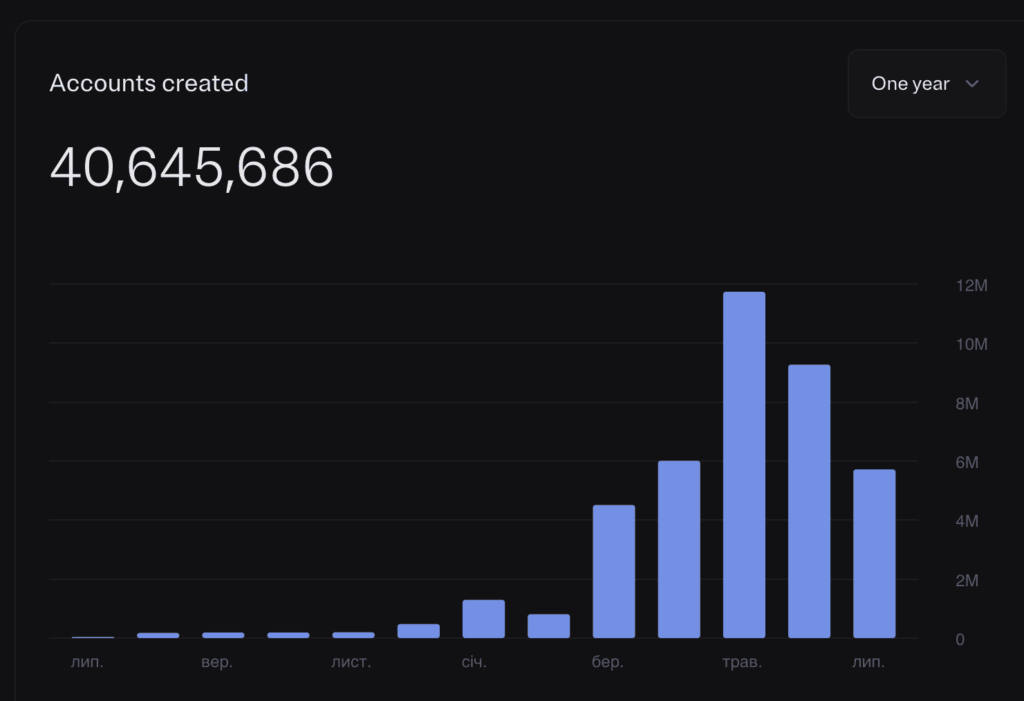

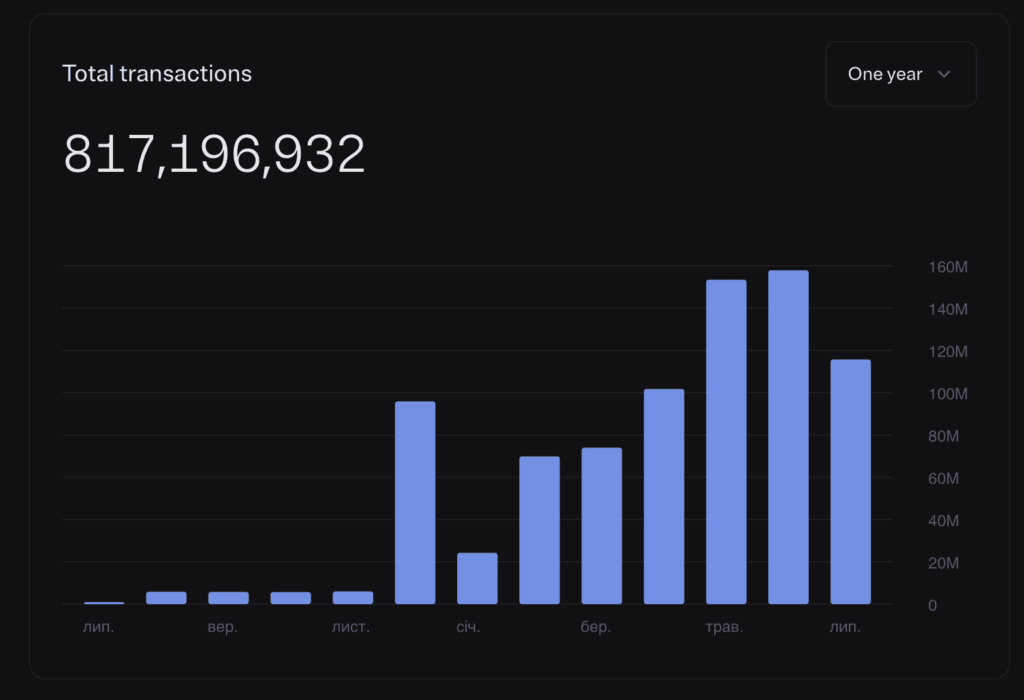

A similar situation has unfolded in the TON ecosystem. If in January 2024 (with the launch of Notcoin) the network processed just over 24 million transactions, then by May and July, this figure reached 153 million and 157 million, respectively, demonstrating a sixfold increase. Regarding the number of new accounts, nearly 1.3 million addresses were created in TON in January 2024, while May recorded a record 11 million.

These charts demonstrate that the peak user activity occurred in May 2024, coinciding with the distribution of the NOT token from Notcoin, while other clicker games gained widespread popularity. It’s possible that we will see record figures again in July-August with the launch of new tokens like CAT from Catizen.

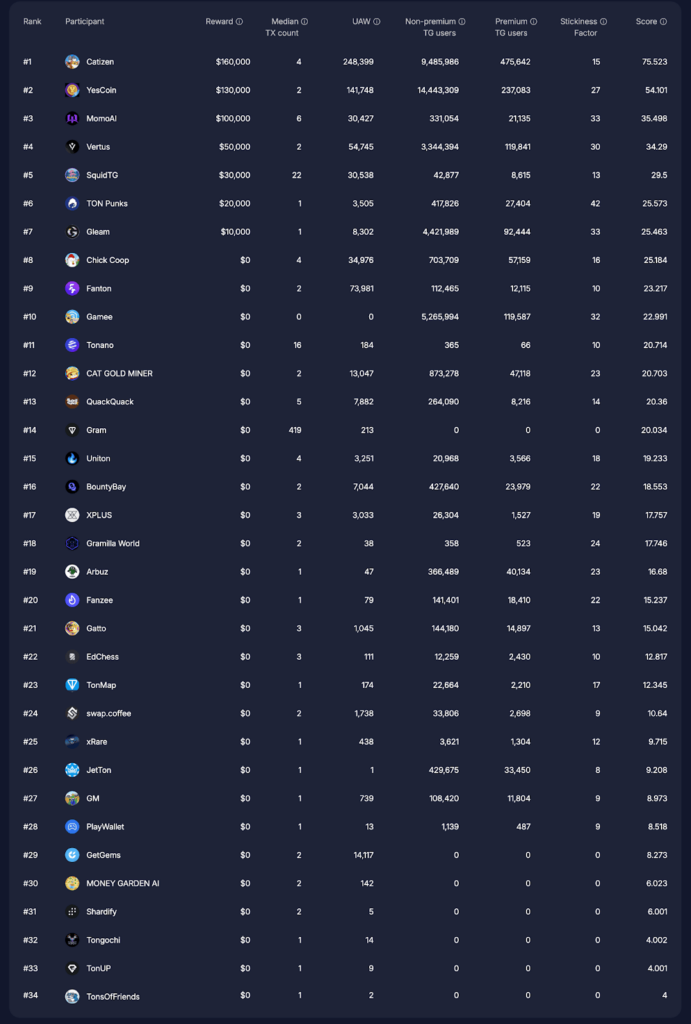

However, it is challenging to assess the performance of gaming projects objectively, as most mini-applications are not dApps and do not provide access to internal information. Only the statements from developers and the results of the latest (fourth) season of The Open League are publicly available.

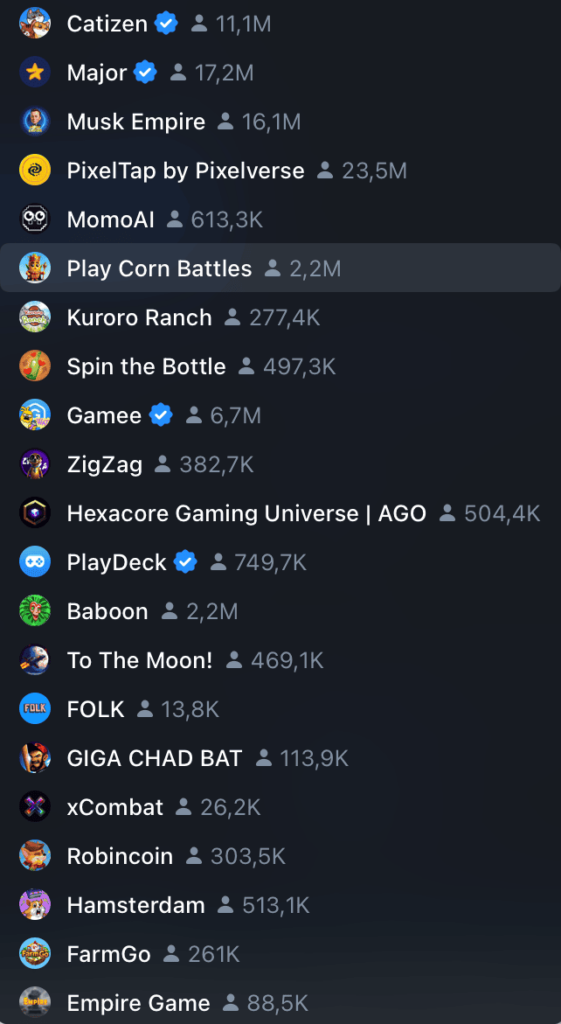

Most other projects do not disclose information about in-game activity, so we have to rely on indirect indicators such as the number of social media followers.

Even by the most conservative estimate, the audience of the largest gaming applications on Telegram numbers in the millions, while dozens of other participants in the table above have attracted hundreds of thousands of players. This demonstrates that the social gaming segment has become one of the main focal points of the messenger’s audience in recent months.

And although it is impossible, given the limited data, to establish a direct link between the popularity of Telegram, the surge in activity in TON, and the growth of the audience for gaming mini-applications, the shared timeframe suggests that these events influence each other.

Will gaming applications help attract 500 million users to TON?

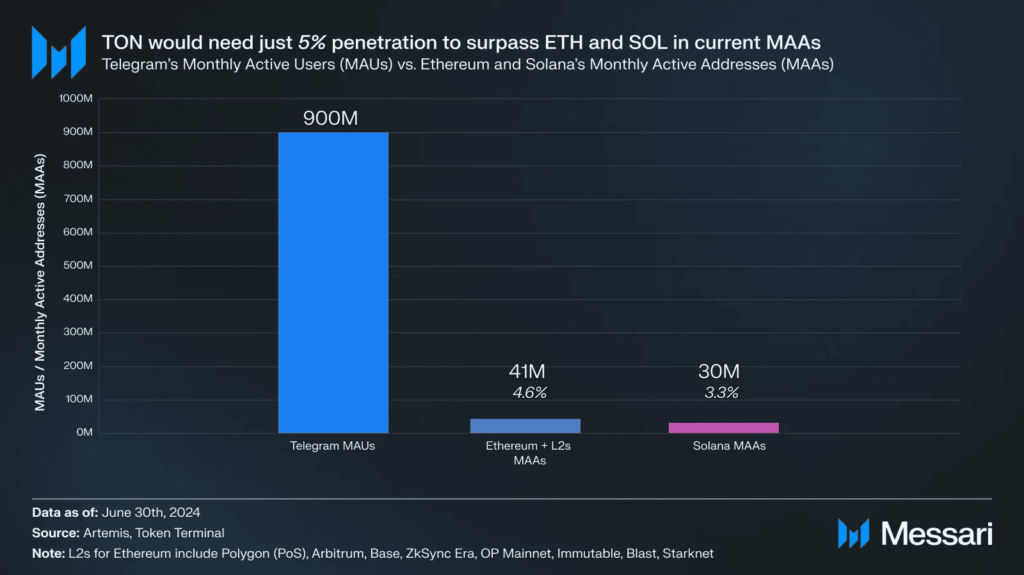

On September 15, 2023, the TON team announced that their goal is to attract 30% of Telegram users to the Web3 industry by 2028. Given the potential growth of the messenger’s audience, this amounts to approximately 500 million people.

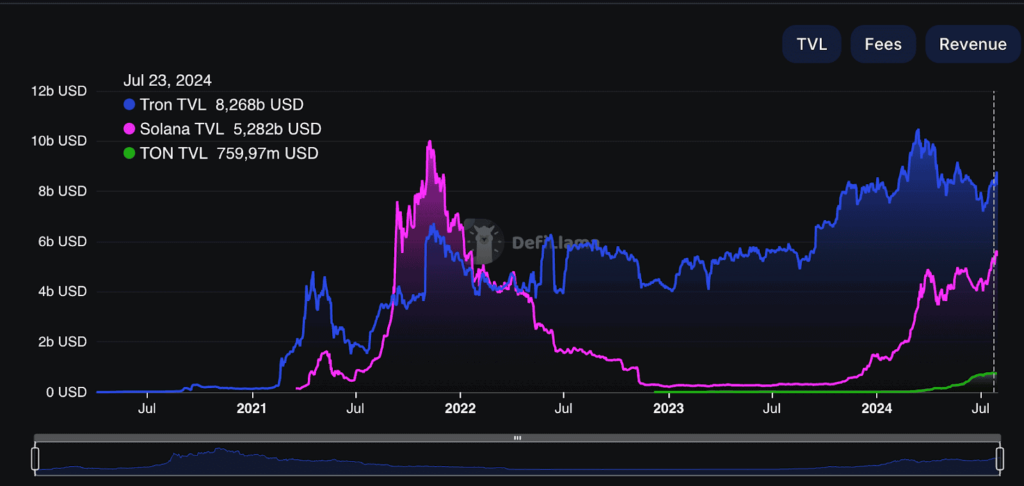

As we mentioned earlier, blockchain gaming is not the only Web3 initiative within the partnership between TON and Telegram—another important area could be in-platform payments. However, it is worth noting that the volume of locked funds in the TON network is more than 10 times lower than that of Tron and 8 times lower than that of Solana, both of which are competing blockchains also focused on fast and accessible payments.

A similar gap can be observed in the supply of stablecoins. The latter serve as the primary payment instrument for most users.

Thus, cryptocurrency payments, if they become a promising tool for attracting users to Web3 for TON in the future, are still in the early stages of development. Therefore, gaming applications remain a key focus for onboarding.

Does social gaming really attract people to blockchain?

The weak point of the thesis regarding the use of social gaming as a “bridge to Web3” lies in the fact that, at the time of writing, most popular gaming projects in Telegram do not have direct integration with blockchain infrastructure.

For instance, the NOT tokens initially served as the in-game currency for Notcoin and were only converted into a digital asset in May 2024. Even after this, the project was not transformed into a full-fledged blockchain application. The same applies to YesCoin, TapSwap, and many other representatives of the segment.

Essentially, these games attract users to the blockchain industry only in preparation for reward distribution, which requires wallet registration or exchange accounts. However, even with the financial incentive and the convenient interface of the Telegram wallet, not all players are willing to delve into the specifics of how distributed networks operate.

Based on the data about the number of Notcoin users who claimed NOT tokens, analysts at Messari noted that the actual conversion rate of the project’s audience is around 12%. At the time of writing, NOT holds 2.4 million wallets—6% of the declared audience of 40 million or half of the token recipients. This indicates that players show relatively low interest in interacting with digital assets in general and NOT in particular.

The situation in other gaming applications can be assessed based on the data from The Open League presented in the previous section. If we compare the number of Telegram users attracted with the number of unique wallets (UAW), we get the following ratio (effectively the conversion rate of players to Web3) for the top 10 projects in the leaderboard.

| Project Name | Telegram Users Attracted | Unique Active Wallets (UAW) | Conversion to Web3 (%) |

| Catizen | 9,961,628 | 248,399 | 2.49% |

| YesCoin | 14,680,392 | 141,748 | 0.97% |

| MomoAI | 352,189 | 30,427 | 8.64% |

| Vertus | 3,464,235 | 54,745 | 1.58% |

| SquidTG | 51,492 | 30,538 | 59.31% |

| TON Punks | 445,230 | 3,505 | 0.79% |

| Gleam | 4,514,433 | 8,302 | 0.18% |

| Chick Coop | 760,868 | 34,976 | 4.60% |

| Fanton | 124,580 | 73,981 | 59.39% |

| Gamee | 5,405,581 | 0 | 0.00% |

It is worth noting that the data largely depends on the gameplay features of the project. For instance, applications like YesCoin are based on a Play-to-Airdrop mechanic and are not dApps, so connecting a wallet is only required to receive the reward. In contrast, projects like Fanton take a different approach by immediately offering an experience of interacting with digital assets.

The Problem of Post-Game User Retention

At the time of writing, gaming projects on Telegram employ various strategies to address the “cold start” problem. While Catizen tries to focus on the gaming experience rather than the token itself, many other applications attract users through Play-to-Airdrop and the promise of rewards.

A common issue with this approach is the decline in audience interest after the financial incentive disappears. However, the consequences of this phenomenon differ for Telegram applications and blockchain platforms.

To receive an airdrop from a conditional ZKsync, a relatively deep immersion in the industry is required, understanding the basic principles of how blockchain works, and often interacting with third-party platforms as part of quest campaigns. Therefore, there is a high likelihood that even if a user loses interest in the project after receiving the token, they will remain in the market, transitioning to other services or networks.

On the other hand, the audience of a typical clicker interacts with the blockchain only to withdraw and sell their reward, gaining minimal information about external projects and the industry as a whole. This effect is intensified by Telegram’s seamless interface, which requires virtually no knowledge of how blockchain works from users. Hence, the question arises—how many people will actually remain in Web3 after receiving their reward, and what will they know about the industry? Given the relatively young age of the social gaming segment in the TON ecosystem, this remains an open question.

Thus, as social gaming is perceived as a key growth driver for TON in the public domain, it is now closely intertwined with the project’s announced goal of attracting 500 million Telegram users to Web3.

However, in reality, the conversion rate of users for most gaming projects is much lower than the targeted 30%, which may be attributed to both the low awareness of the audience regarding digital assets and the fact that the gameplay of many applications does not require direct interaction with the blockchain until the token launch.

With the current conversion rates of mini-apps, the figure of 500 million users seems unlikely. Although it should be noted that, according to Messari analysts, a conversion rate of 5% is sufficient for TON to lead the industry, which may well be within the capabilities of social gaming.

However, another important question is user engagement in Web3 beyond a specific project. It remains unclear whether gaming applications can maintain audience interest after giveaways and keep users within the industry.

Essentially, the assessment of the TON team’s approach largely depends on how one defines Web3 users. If we consider people who have interacted with decentralized infrastructure at least once (perhaps even without realizing it), then a series of viral mini-apps combined with airdrops could yield significant results. However, if we talk about an active audience willing to engage with blockchain services and assets beyond Telegram, gaming applications do not seem to be the best tool for fostering that engagement.