According to Grayscale, in 2024, alongside Bitcoin, significant growth was observed in certain segments of the cryptocurrency market, such as artificial intelligence and tokenized assets (RWA), increasing demand for related infrastructure projects. This led to a price rally for several altcoins noted by the company’s analysts.

In this review, we will explore the top 10 altcoins from Grayscale’s ranking, which exhibit high growth potential and may strengthen their positions in the market in the medium to long term.

Criteria for Selecting the Best Altcoins

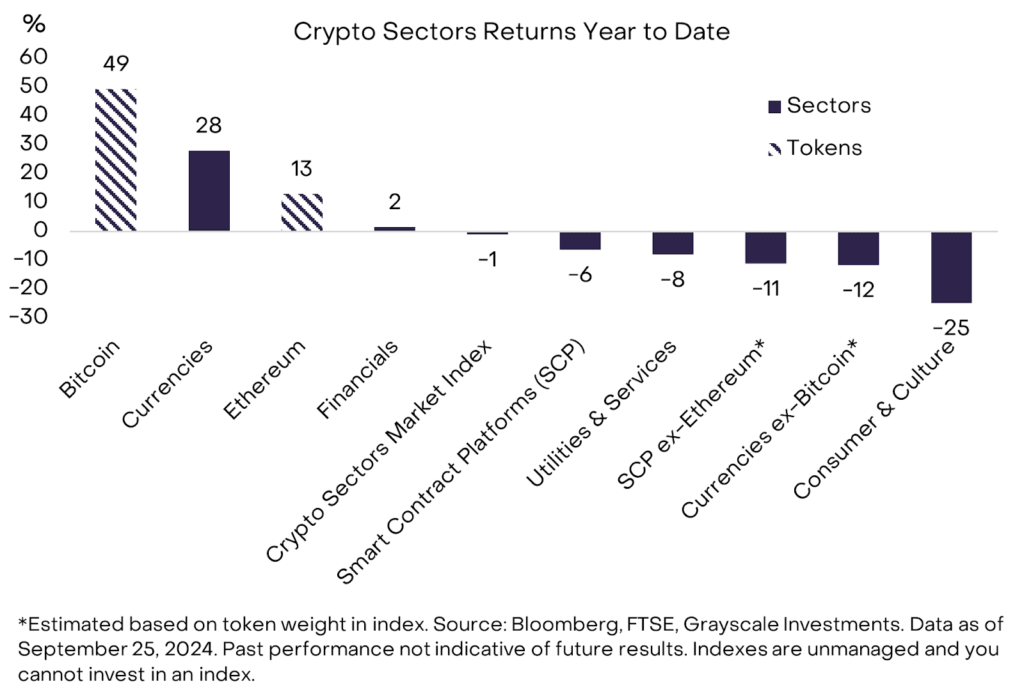

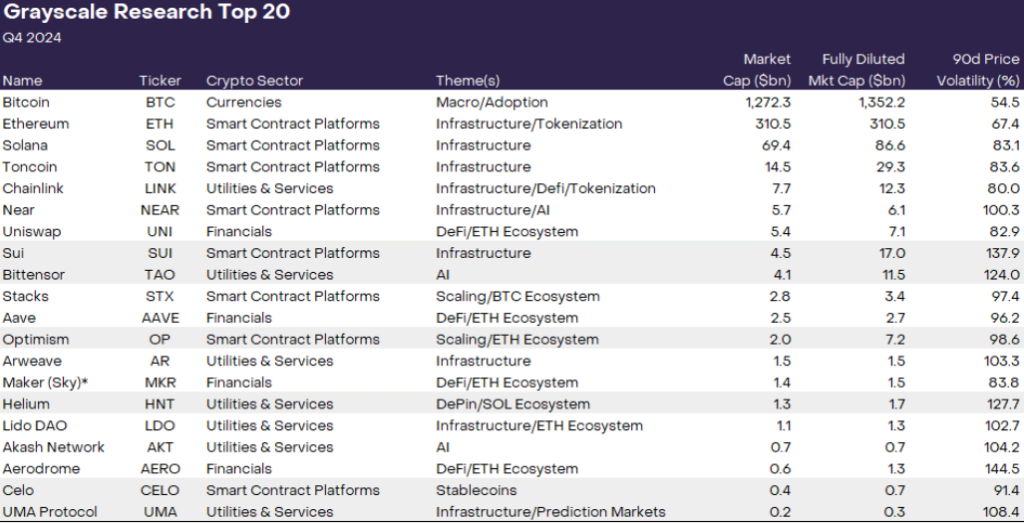

The report presented by Grayscale Research at the end of September 2024 includes 20 promising assets from various segments of the industry. During the ranking process, analysts utilized indices developed in partnership with FTSE Russell, allowing tokens to be divided into several categories: cryptocurrencies, smart contract platforms, finance, culture, and services.

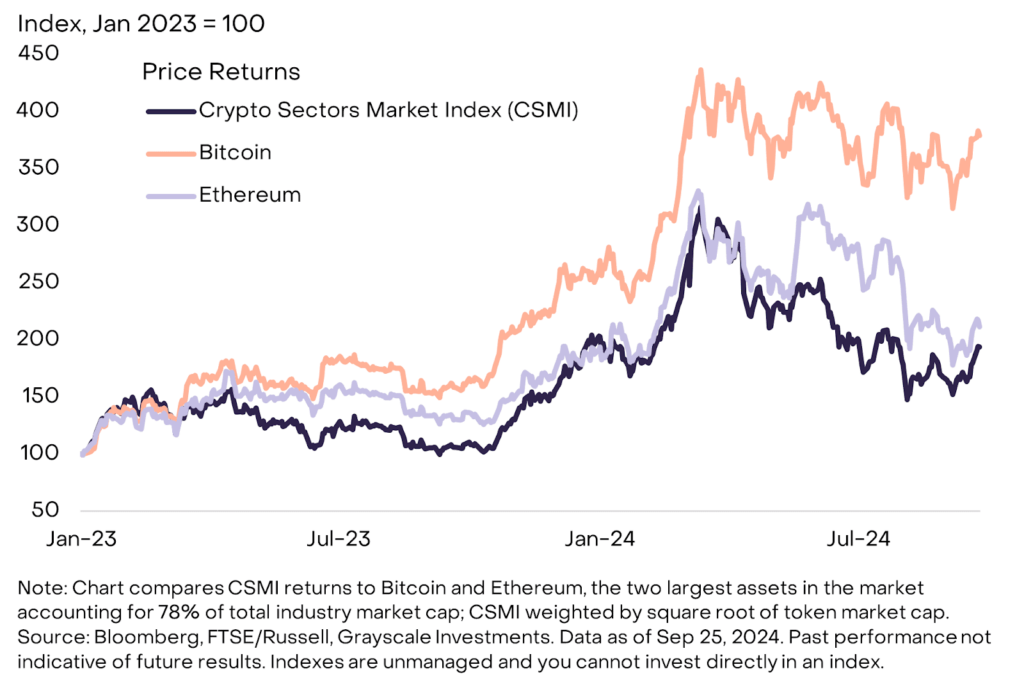

To measure the growth of the assets included in the report, the Composite Crypto Sectors Market Index (CSMI) is employed.

Based on the context of the report and the provided data, we can conclude that when evaluating a specific token, the following factors are taken into account:

- Ecosystem activity and user growth

- Protocol updates or the launch of new products that can increase the asset’s value

- Market indicators of the asset, such as price, liquidity, and listings

- Regulatory, political, and macroeconomic risks that may impact the specific project and the market as a whole.

The changes in the altcoin list in the latest report, according to the authors, reflect shifts in trends within the industry landscape. In particular, there is a growing interest in smart contract platforms, artificial intelligence, and tokenized assets, which are attracting capital and users in the new market conditions.

Top 10 Altcoins for 2024-2025

Grayscale highlighted 20 promising cryptocurrencies that may show growth in 2024 and further unlock their potential in 2025. It is noted that a possible price rally may be influenced by external political and economic factors, such as the U.S. elections, which could either accelerate or slow it down.

Below, we will take a closer look at the top ten assets from the list, excluding Bitcoin, providing an overview and key advantages of each project.

Ethereum

Ethereum (ETH) maintains its leadership among smart contract platforms, despite pressure from competitors like Solana, Toncoin, and Sui. The Ethereum ecosystem stands out with the largest number of developers, a record amount of total value locked (TVL), and favorable treatment from U.S. regulatory bodies. The anticipated hard fork, Pectra, is expected to enhance the network’s efficiency, further solidifying its position amid growing interest in infrastructure solutions.

Solana

Solana (SOL) continues to gain popularity due to its low fees and fast transaction processing. The rise of meme coins and the development of DeFi services have spurred user influx, allowing the project to secure fifth place in the overall cryptocurrency ranking, despite the decline following the FTX collapse.

Toncoin

Toncoin (TON) has emerged as one of the notable players in 2024, thanks to its integration with Telegram and the launch of several products aimed at attracting a mass audience, such as GameFi applications and payment services. Since spring 2024, TON has experienced a 300% increase in value, with the project’s market capitalization currently standing at $13 billion.

Chainlink

Chainlink (LINK) remains the primary data provider for smart contracts, playing a crucial role in DeFi. In 2024, the project’s significance in the tokenized assets segment has also increased considerably, aided by the secure cross-chain solution, CCIP. As of the time of writing, LINK, with a market capitalization of $7 billion, ranks 16th in the overall cryptocurrency ranking.

Uniswap

Uniswap (UNI) is a key platform for decentralized trading and has become synonymous with DeFi. Uniswap is the dominant exchange within the Ethereum ecosystem and the largest in the industry, continually developing new solutions and products for storing and exchanging digital assets. The UNI token, with a market capitalization of over $5 billion, ranks 22nd in the cryptocurrency rankings. However, increasing regulatory scrutiny may pose new challenges for the project.

NEAR Protocol

NEAR Protocol (NEAR) is a scalable blockchain with low fees and high throughput, competing with Ethereum and Solana as an infrastructure for decentralized applications. The project team is working on areas related to AI integration as well as blockchain abstraction. At the time of writing, the NEAR token ranks 21st in the overall cryptocurrency rankings, with a market capitalization of $5.8 billion.

Sui

Sui (SUI) is a next-generation blockchain developed by former Meta engineers, focusing on high transaction speed and scalability. Recent updates have increased transaction speed by 80%, contributing to a 170% rise in price and growing popularity of the platform. Sui has a market capitalization of $5.8 billion, and the network is attracting attention and investment capital due to its focus on developing DeFi and decentralized applications.

Bittensor

Bittensor (TAO) stands out amid the growing interest in the integration of blockchain and artificial intelligence. The platform provides a decentralized infrastructure for AI solutions, offering economic incentives for hardware providers and AI agents. Bittensor ranks 25th in the overall cryptocurrency rankings with a market capitalization of $4.6 billion, demonstrating potential for long-term growth amid the rising popularity of AI.

Stacks

Stacks (STX) extends the capabilities of the first cryptocurrency by adding support for smart contracts and DeFi. The project has gained recognition as one of the first and most popular second-layer networks for Bitcoin and currently ranks 35th in the cryptocurrency rankings with a market capitalization of $2.7 billion.

Aave

Aave (AAVE) is one of the oldest and largest DeFi platforms, offering lending services secured by cryptocurrency collateral. Its high market capitalization and active community ensure steady growth, while participation in the Ethereum ecosystem and the development of new solutions strengthen the project’s market position. With a market capitalization of $2.2 billion, Aave ranks 42nd in the cryptocurrency rankings.

All the tokens listed above are among the most capitalized assets in the market, confirming the dominance of smart contract platforms and the growing interest in DeFi and artificial intelligence. It is worth noting that assets not included in this article from the second part of Grayscale’s ranking generally represent the same market segments.

Expert Predictions for Altcoins

Expert opinions on Ethereum and other altcoins for 2024 are divided.

Cryptology forecasts that the price of Ethereum could reach $5,000 if the market maintains a “bullish” trend through the end of the year. It is crucial for the asset to recover from summer dips in October and November; otherwise, the momentum may weaken.

Florian Wimmer from Blockpit emphasizes that in 2024, attention should be paid to Solana, Avalanche, and Layer-2 solutions for Ethereum, such as Polygon and Arbitrum. Among newcomers, he highlights SUI, SEI, and Ronin as assets with significant potential, and this assessment partially aligns with Grayscale’s ranking.

At the same time, analysts at AMBCrypto point to a low probability of Ethereum surpassing the $3,000 price level before the U.S. elections. Investors expect that regulatory clarity, which may come with a new administration, will determine the future price movement.

Overall, investors should focus on L2 solutions, new decentralized applications, and RWA projects. Diversifying the portfolio by including assets from various market sectors can help minimize risks in the face of regulatory and economic uncertainty.

Investment Risks in Altcoins

As demonstrated by the performance comparison of the Grayscale index with Bitcoin and Ethereum, altcoins can offer higher returns.

At the same time, they are also associated with a number of risks, including:

- Sharp price fluctuations due to news, rumors, or changes in investor sentiment—this is the norm for altcoins.

- Low liquidity, particularly related to the issue of so-called “VC coins” with a small circulating supply.

- Regulation and political situations. Tightening regulations in various countries can impact DeFi and altcoins. Elections in the U.S. also play a significant role, increasing investor uncertainty.

- High competition. The crypto market is saturated with new projects, and only those that offer unique solutions will maintain leadership. Even strong players like Solana and Sui must continue to evolve to remain competitive.

In addition to these risks, investors should be prepared for “black swans”—unpredictable events with serious consequences. These can include sudden regulatory changes, economic crises, or political conflicts that can crash the cryptocurrency market and lead to the downfall of individual projects.

How to Invest in Altcoins Properly

To minimize capital loss due to the aforementioned risks, it is important for investors to follow several basic rules.

Research the Project and Its Potential

Before investing, understand how the project works, its ecosystem, and its team. Examine the technology it offers and how it differs from competitors. It is crucial to comprehend how the project addresses existing market problems and what partnerships it has. For example, the integration of TON with Telegram provided a significant boost in user growth for the network.

Assess Tokenomics and Emission Risks

Transparent and balanced tokenomics is one of the key factors in a project’s sustainability. Investigate how tokens are distributed, particularly among the team and major investors. If a significant portion of tokens is concentrated among early participants, it may lead to manipulation. Successful projects offer mechanisms that encourage token retention, as seen with Aave, Ethereum, or Solana.

Diversify Your Portfolio

Invest in several projects across different segments to reduce risks. For instance, you can allocate capital among L2 solutions, DeFi protocols, and layer-one blockchains. This approach allows you to take advantage of various market trends, whether it’s the growth of DeFi or the popularity of infrastructure projects.

Develop an Exit Strategy

Set profit targets and loss limits in advance. Use stop-loss and take-profit orders to minimize losses and secure profits. A clear exit strategy allows you to maintain control over your investments and avoid panic decisions in a volatile market.

These steps will help you develop a more systematic approach to investing in altcoins and effectively manage risks in this dynamic market.

FAQ

Which Altcoin is the Most Popular?

According to Grayscale, the most popular altcoin is Ethereum (ETH). It leads among smart contract platforms and remains a key asset in DeFi.

Which Altcoins are Currently Growing?

The prices of cryptocurrencies are constantly changing. To track quotes, you can use services like CoinMarketCap or CryptoRank.

Which Coins Might “Take Off” in 2025?

Predictions depend on macroeconomics, regulatory changes, and technological trends. Grayscale recommends paying attention to the Ethereum ecosystem, as well as projects like Solana, Avalanche, SUI, and Bittensor, which may emerge as leaders in the development of DeFi and AI.