Disclaimer: This material is provided for informational purposes only and does not constitute financial advice or a call to action. Incrypted is not responsible for the investment decisions of readers.

One of the most active segments of the crypto market in 2024 is meme coins—tokens based on popular internet memes or characters that have a humorous and entertaining nature. According to CoinMarketCap, as of the time of writing, the total market capitalization of this asset class exceeds $48 billion, and the daily trading volume surpasses $3 billion, indicating high interest from users.

Investing in meme coins is high-risk due to their volatility and strong dependence on influential figures and influencers. However, this characteristic also creates opportunities for rapid wealth accumulation, which attracts many retail investors.

In this article, we will explore in more detail how meme coins work, how much one can earn from them, and what to consider when making such investments.

The History of Meme Coins

In late 2013, programmers Jackson Palmer and Billy Markus released the first meme coin, Dogecoin (DOGE)—a Bitcoin fork based on the popular internet meme Doge, which features a Shiba Inu dog.

Initially, the developers viewed the coin as a joke, but according to them, in the first 30 days, the official website of the project received around 1 million visitors, and in the first two weeks, the daily number of transactions exceeded that of Bitcoin. One of the key factors for this growth was the popularity of the asset among users of the social network Reddit, who used it as “tips” for content creators.

In the following years, several other meme coins emerged, such as Dentacoin (DCN) and Pandacoin (PND), but the segment remained relatively unknown. Everything changed thanks to a tweet from Elon Musk at the end of 2020, supporting Doge.

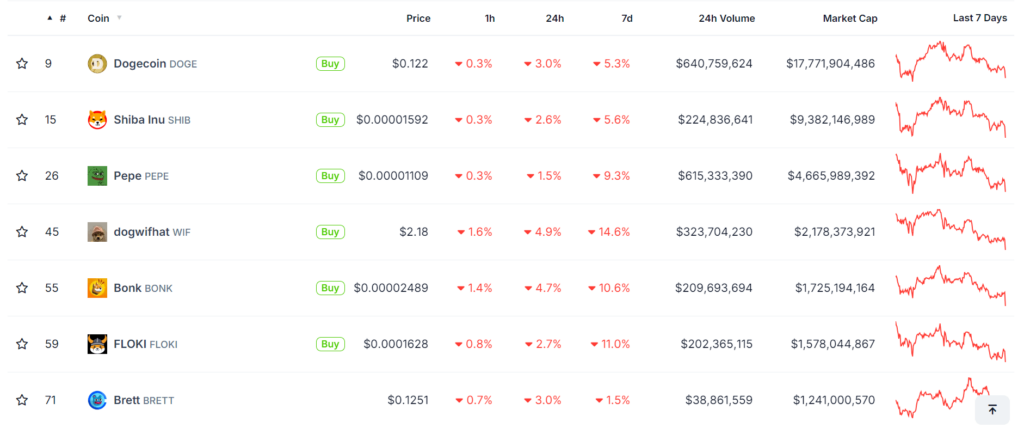

Subsequently, more and more meme tokens began to appear, such as Shiba Inu (SHIB), SafeMoon Inu (SMI), Hoge Finance (HOGE), and Baby Doge (BabyDoge). The latter, by the way, also received support from Musk. Since then, the list of the most popular assets in the segment has changed repeatedly and currently looks as follows.

It is worth noting that in 2024, the popularity of meme coins continues to grow both within the industry and beyond, and the tokens in this segment are regarded as a cultural phenomenon and an important investment tool in the cryptocurrency market.

How do meme coins work?

From a technical standpoint, meme coins operate on the same principle as other tokens, utilizing smart contracts in networks such as Ethereum, Solana, TON, and others. They typically have a very large or unlimited supply, along with a disproportionate distribution where major investors hold a significant amount of the assets.

The main difference between meme coins and traditional cryptocurrencies lies in their purpose and their dependency on the perception of the crypto community. Meme coins are often created as a joke or a speculative tool, and their value is largely determined by their popularity on social media, support from influencers, community engagement, and the culture and popularity of memes.

This distinguishes them from traditional cryptocurrencies and tokens, whose value is usually tied to the technology and utility of the projects behind them.

Strategies for Earning with Meme Coins

Now let’s move on to specific investment strategies for meme tokens. Among them:

- Buying and Holding (HODL): The essence of this approach is to hold the asset for a sufficiently long period, anticipating targeted price growth. This strategy ignores short-term market fluctuations and is suitable for relatively passive investors who are willing to lock up their assets for a time.

- Short-Term Trading and Speculation: This involves buying a meme token for a short period, typically lasting from a few minutes to several days, and realizing profits during the next price fluctuation. It requires constant market engagement and developed trading skills.

- Searching for Early Promising Coins: The essence of this method is to find potentially profitable but currently little-known and therefore undervalued meme tokens in the market. This necessitates conducting detailed analyses of new assets, monitoring wallets with large balances (whales), or participating in early token sales.

- Creating and Promoting Your Own Meme Coin: This is also a common earning strategy, especially with the emergence of platforms for easily creating and launching coins, such as pump.fun, Moonshot, Basecamp, and GasPump. These services allow users to launch their own meme tokens for a small fee and without any technical knowledge, while also protecting investors from certain risks.

- Sniping: The essence of this method is to buy a coin in the first seconds after trading begins at the initial price, while users have not yet had time to react to the appearance of the new asset. Typically, special software in the form of sniper bots like BONKbot is used for this type of trading, which directly interacts with smart contracts bypassing user interfaces.

Traders and investors can choose their own strategy or combine several approaches, adapting to their own capabilities, needs, and market conditions. However, any strategy should take into account the potential risks and unpredictability of this market segment.

Risks and Warnings When Investing in Meme Coins

Before investing in meme coins, it’s essential to understand the risks associated with them.

First and foremost, assets in this segment are known for their high volatility, meaning significant price fluctuations over short periods. Additionally, meme coins carry a high risk of fraud and price manipulation. For example, developers may retain a large portion of the tokens during distribution and sell them after the price increases, significantly devaluing the coin, as was the case with Neiro.

While it is impossible to completely shield yourself from such risks, a few simple rules can help reduce their likelihood and protect your investments:

- Thoroughly Research the Project: Before buying a token, carefully investigate the project, its team, roadmap, and so on. Ensure that the token is supported by a strong community or influential figures in the industry, and gather as much additional information as possible.

- Diversify Your Investments: It’s important not to “put all your eggs in one basket.” Allocate several digital assets, possibly of different themes, and distribute your investments among them to diversify your risks.

- Engage with the Token Developers: Try to communicate with the token developers on social media and monitor how the team builds communication with the community as this factor often influences the success of meme coins. A lack of activity from the creators can lead to a quick decline in interest and a drop in the token’s value.

- Develop a Trading Strategy: Have a well-defined buying and selling strategy for the coin with established price levels. This will help you lock in profits in a timely manner and minimize losses in the event of unpredictable price reversals.

Examples of Successful Investments in Meme Coins

On July 1, 2024, the analytics company Lookonchain reported that an unknown trader increased their investment by 307 times thanks to the meme coin BAKED. They turned ~$10,000 into over $3 million in just 30 minutes.

Here’s the translation with the requested formatting:

Another Successful Investment Example

Another successful investment occurred in May 2024, when a user managed to achieve a profit of 762x from their initial deposit in just five hours. They spent 5.14 SOL to purchase 86.55 million of the meme token MOTHER, which accounted for 8.66% of the total supply. On the same day, the trader sold 80.41 million MOTHER for 3,035.5 SOL.

In early June 2024, the meme token PEW provided a trader with a profit of 140x in just four days, allowing them to turn $12,300 into $315,000.

These are just a few examples of successful investments in meme tokens that have yielded incredible profits for investors. However, it’s essential to remember that for every successful investment case, there are hundreds or even thousands of users who have incurred significant losses while searching for “the one” asset that will help them get rich quickly. High potential returns are always associated with equally high risks.

How to Start Investing in Meme Coins?

To buy meme coins, you can use both decentralized and centralized exchanges, as well as platforms for launching tokens like pump.fun, Basecamp, and similar sites. However, it’s important to note that exchanges like Binance, Coinbase, or Kraken only trade the most popular and highly capitalized tokens, while most meme coins are typically traded on DEXs like Raydium or Uniswap.

You also need to take care of a wallet for storing your assets in advance. Today, there are various options on the market, from hardware devices like Ledger to applications like MetaMask or TrustWallet. You can learn more about the basic operations with digital assets in our beginner’s course.

Overall, the process of acquiring meme coins is the same as for any other tokens and consists of the following steps:

- Create an account on your chosen platform or connect a wallet to it.

- Fund your account or wallet balance by purchasing cryptocurrency using a credit card or other available methods, such as P2P.

- Select the meme coin you’re interested in using the search by name or smart contract address.

- Make the purchase through the platform interface, such as via a trade order or by executing an on-chain swap.

- Assets acquired on a centralized exchange can be withdrawn to an external wallet for safe storage.

Selling assets is done in the same order. The main task of the investor is to correctly choose what and when to buy, as well as when to realize profits.

You can track news about the launch and listing of meme tokens, as well as the development of related projects, in the Telegram channel MEMEcrypted. Current events in the meme coin market are always at your fingertips.

Conclusion

Despite their origin as a “joke” cryptocurrency, meme coins gained significant popularity in 2024 due to the support of influencers, active communities, and a shift in perception of this asset class. Furthermore, meme tokens remain an important part of the cryptocurrency market, serving as a tool for attracting new users to Web3.

In the crypto industry, the meme coin segment is characterized by high returns and an equally high risk of fraud, which can lead to loss of funds. To mitigate these risks and effectively capitalize on market opportunities, investors need to thoroughly research projects related to meme tokens, use reliable platforms, and diversify their investments.