On the night of Saturday, October 26, the price of the first cryptocurrency temporarily fell below $66,000.

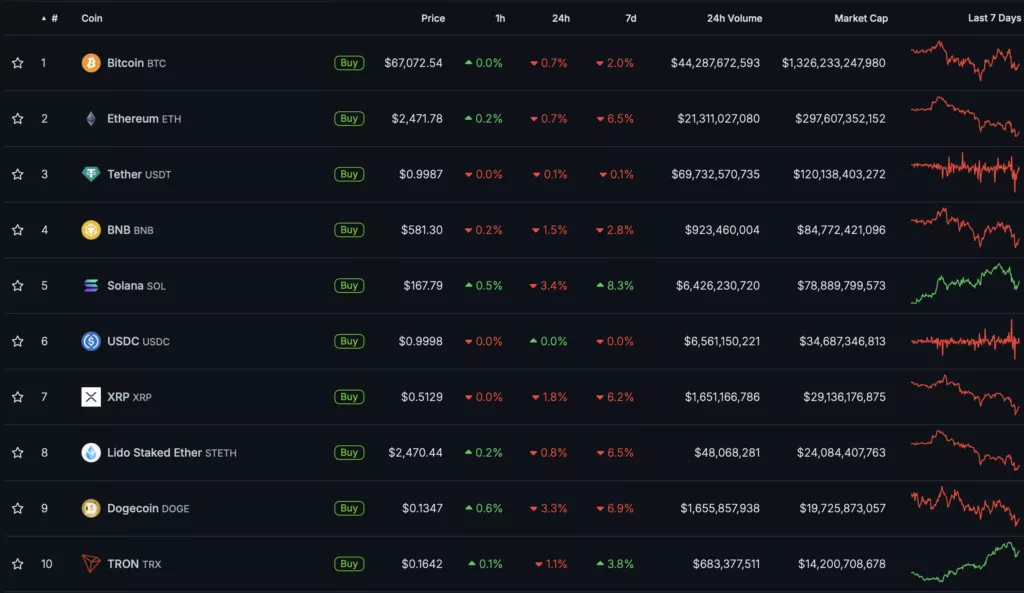

At the time of writing, Bitcoin is trading above $67,100. According to CoinGecko, digital gold has lost 0.7% in the last 24 hours, with a market capitalization exceeding $1.3 trillion.

A likely reason for the temporary correction in the cryptocurrency market is Israel’s attack on Iran.

All digital assets in the top 10 by market capitalization have moved into the “red zone” following Bitcoin. Solana (-3.4%) and Dogecoin (-3.3%) experienced the most significant losses over the day.

The total market capitalization of digital assets is $2.38 trillion, with Bitcoin’s dominance index at 59.4%.

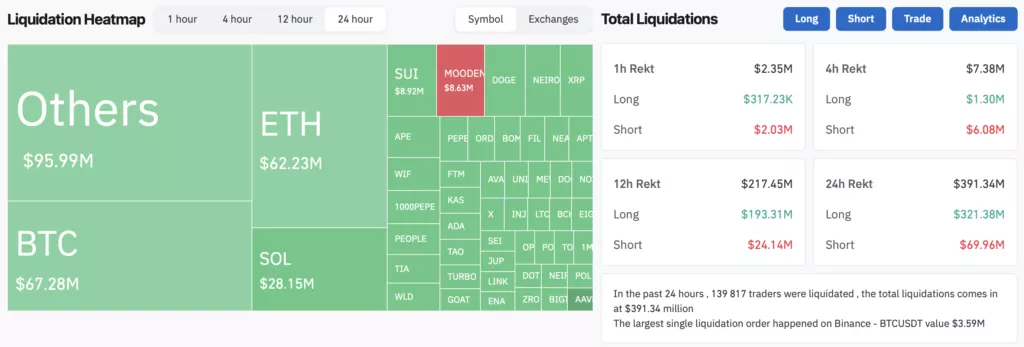

According to Coinglass, the total volume of liquidated positions in the last 24 hours amounted to $391 million, of which $321 million was attributed to longs.

On Monday, October 21, the first cryptocurrency tested the $69,000 level. A week prior, the asset was trading below $60,000.

Analysts at Bernstein reiterated their forecast of Bitcoin reaching $200,000 by the end of 2025, describing it as “conservative.” They highlighted the investment attractiveness of the first cryptocurrency amid rising U.S. national debt and inflation threats.

Jeff Kendrick, head of digital asset research at Standard Chartered, stated that Bitcoin could break its historical high of over $73,000 around the time of the U.S. elections, which he believes could happen on November 5.

Analysts at Hashkey Capital emphasized that simply exceeding the historical maximum by digital gold is not enough to kick off the altcoin season. They estimate that Bitcoin needs to reach the range of $76,000 to $108,000 for that to occur.