Microsoft Corporation intends to consider the possibility of acquiring the first cryptocurrency. The company will vote on this matter at the shareholders’ meeting in December. The board of directors recommends rejecting the proposal.

Microsoft Corporation will explore the potential opportunity to invest in Bitcoin. Representatives of the tech giant will put this issue to a vote during the shareholders’ meeting scheduled for December 10, 2024.

The company’s interest in the first cryptocurrency became known through documents filed with the U.S. Securities and Exchange Commission (SEC). The so-called “Bitcoin Investment Assessment” was proposed by the National Center for Public Policy Research.

The organization in question is a conservative group that is part of the advisory council for the Project 2025 initiative. This coalition promotes a policy aimed at addressing and reforming the shortcomings of big government and the undemocratic administrative state.

The U.S. Securities Act allows investors who own a sufficient number of shares and hold voting rights to submit various proposals for consideration at the shareholders’ meeting. The final decision on such matters is made at this meeting, rather than by the company’s board of directors.

In Microsoft’s statement, it was clarified that the corporation’s treasury and investment services group evaluates a wide range of assets, including those that may provide protection against inflation.

“Past assessments have included Bitcoin and other cryptocurrencies among the options under consideration, and Microsoft continues to monitor trends and events related to crypto assets to inform future decision-making,” the press release stated.

It is worth noting that the submitted SEC document contains a separate line stating that Microsoft’s board of directors opposes this proposal. According to the corporation’s governing body, the issue is not relevant since the board is already “carefully considering such a possibility.”

Among the factors that could negatively impact investment in digital assets, the company cites volatility. Additionally, the statement mentions that Microsoft already has integrated processes for managing and diversifying its corporate treasury.

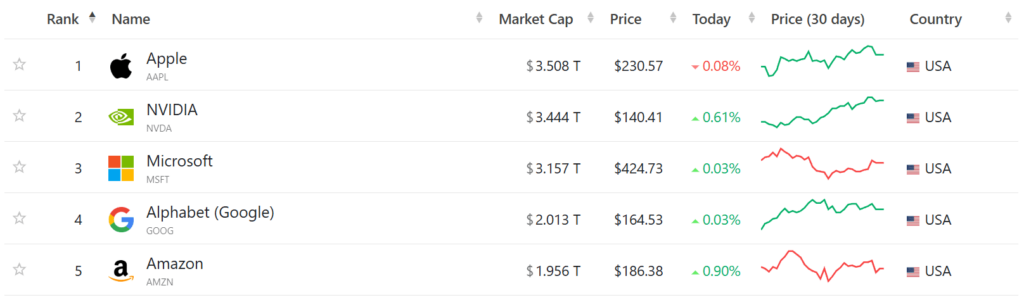

As of the time of this writing, the corporation is the third-largest company in the world, with a market capitalization estimated at $3.157 trillion and a share price holding steady at $424.7, according to CompaniesMarketCap.

Recall that BlackRock and Microsoft will establish a $30 billion fund for investments in AI.