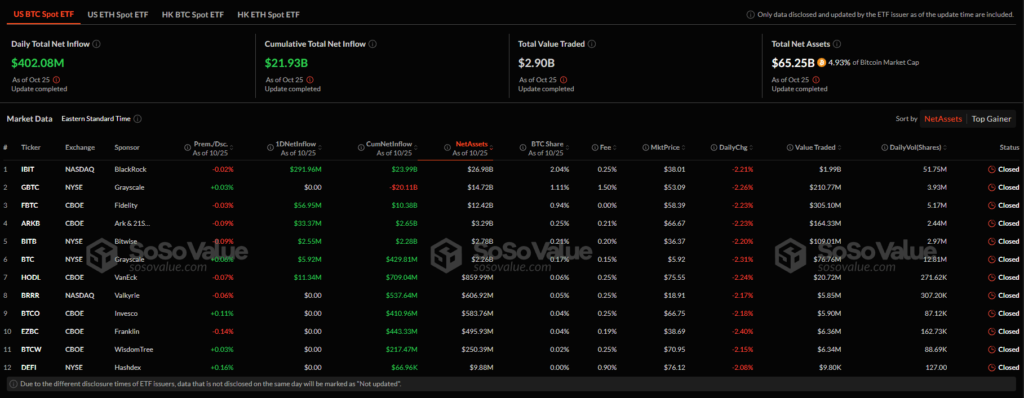

On October 25, the segment of American crypto funds based on the first cryptocurrency saw an inflow of $402.8 million. The leader in inflows was the spot Bitcoin ETF from BlackRock, with approximately $292 million. The Ethereum-based exchange-traded fund sector recorded an outflow of over $19 million.

On October 25, 2024, the net inflow into spot Bitcoin ETFs amounted to $402.8 million. The majority of the financial inflows were directed towards the crypto fund from BlackRock. The investment product under the ticker IBIT received nearly $292 million, according to SoSo Value.

In second place by the amount of capital received is the ETF from Fidelity Investments. The spot Bitcoin ETF under the ticker FBTC recorded inflows of $56.9 million.

The third position in this regard belongs to the investment product from Ark Invest and 21Shares. Financial inflows into the cryptocurrency fund ARKB amounted to $33.4 million.

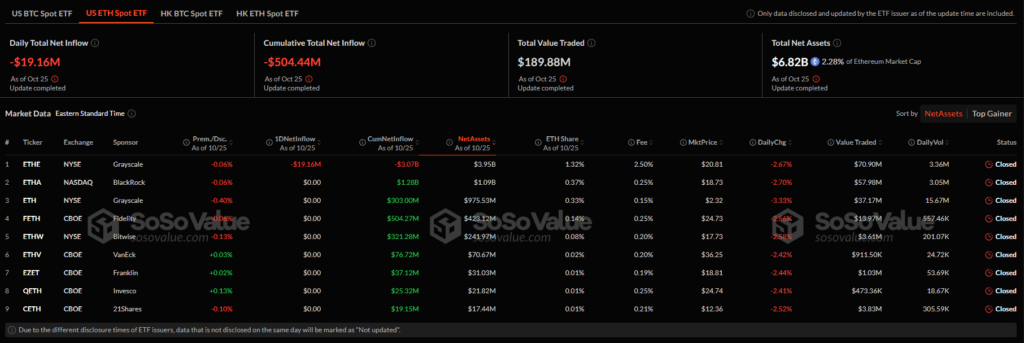

In addition, inflows were recorded for spot Bitcoin ETFs from the following companies:- VanEck (HODL) — $11.3 million; – Grayscale Investments (BTC) — $5.9 million; – Bitwise Asset Management (BITB) — $2.6 million. Six investment products based on the first cryptocurrency ended the previous trading day with zero inflow/outflow figures.As for spot Ethereum ETFs, this segment recorded a loss of $19.16 million. All funds were withdrawn from a single ETF under the ticker ETHE, owned by the financial giant Grayscale.

Since its market launch, the investment product ETHE has lost $3.07 billion. Meanwhile, the total assets under management for the fund remain at $3.95 billion, making it the leader in its asset class.

The U.S. Securities and Exchange Commission has approved the applications from the NYSE and Cboe exchanges to trade options on spot Bitcoin ETFs.