As is well-known, one of the main challenges facing distributed networks is the so-called “blockchain trilemma,” which involves finding a balance between scalability, security, and decentralization without sacrificing any of these factors.

For instance, while Ethereum is a relatively secure and decentralized network, it often faces criticism for slow transactions and high fees due to scalability issues.

In search of alternatives, new crypto projects are emerging with the goal of addressing these challenges. One such project is Avalanche, whose developers claim it is the “fastest smart contract platform in the blockchain industry.”

In this article, the Incrypted team will explain what Avalanche is and how it works.

What is Avalanche?

Avalanche is a layer-one blockchain that operates using smart contracts.

The system offers functionality similar to Ethereum and other layer-one blockchains. Developers can create tokens, NFTs, and dApps. Users can stake tokens, verify transactions, and utilize over 400 different applications.

History of Creation and Development

The foundational principles of the protocol were first published in the InterPlanetary File System (IPFS) in May 2018 by a group of enthusiasts under the pseudonym Team Rocket.

Subsequently, Emin Gün Sirer, an engineer and professor of computer science at Cornell University, decided to create a network known as Avalanche. In 2018, Sirer co-founded AVA Labs with two of his Ph.D. students, Kevin Sekniqi and Maofan “Ted” Yang, to develop the technology underlying this blockchain. Avalanche officially launched its mainnet in September 2020.

Later, in September 2021, Ava Labs secured $230 million in investments from Polychain and Three Arrows Capital.

Since then, the project team has continually improved the network and announced new partnerships. For example, in January of this year, a partnership was established between Avalanche and Amazon Web Services (AWS) to enhance the blockchain’s infrastructure and the decentralized ecosystem of applications.

How Does Avalanche Work?

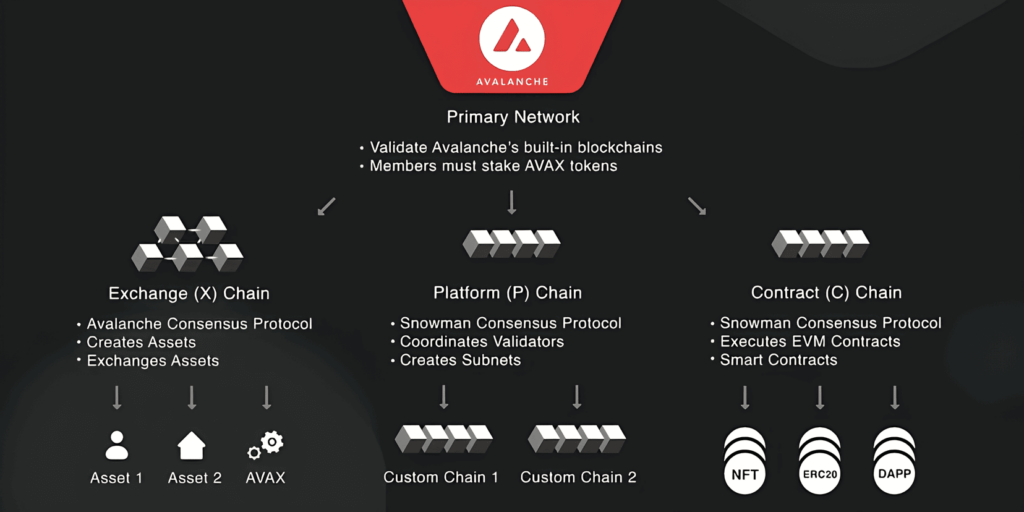

Avalanche operates on a system based on smart contracts and the Avalanche Mainnet, which includes the primary network consisting of the X, P, and C-Chain, as well as all existing subnets.

Transaction processing occurs in parallel. Validator requests are selectively forwarded to each other without additional confirmations. This allows nodes to form groups of transactions for voting, which occurs in several stages.

What Consensus Algorithms Does Avalanche Use?

The Avalanche consensus algorithm is based on Proof of Stake (PoS). Once a node receives an incoming transaction, it checks its validity and solicits the opinions of a small number of other randomly selected nodes. If the overwhelming majority supports a variant different from the one proposed by the validator, it automatically agrees.

The process continues by querying another subset of nodes for their opinions on the transaction. This repeats until convergence is achieved, and the network reaches a state of consensus.

This structure makes Avalanche very resistant to 51% attacks, as potential hackers would need to eliminate 80% of the network’s validators to succeed.

Key Components of Avalanche

The primary Avalanche network is divided into three blockchains:

- X-Chain: Responsible for creating and trading AVAX tokens and other digital assets.

- C-Chain: Allows for the creation of smart contracts written in Solidity. It is an implementation of the Ethereum Virtual Machine (EVM), enabling developers to easily port their projects from Ethereum to Avalanche.

- P-Chain: Coordinates validators, tracks active subnets, and enables the creation of new ones. It utilizes the Snowman consensus protocol, a variant of Avalanche consensus optimized for smart contracts and simple sequential transactions.

Instead of running all smart contracts on a single network, Avalanche allows users to deploy subnets that can operate under their own rules.

Each subnet can have its own governance model, enabling communities to establish consensus mechanisms and rules that best suit their specific blockchain.

All validators can participate in verifying transactions for specific subnets of their choice, while developers can set special rules and requirements (such as KYC, location, etc.) for validator nodes operating in their subnet.

Although subnets operate independently, they are not isolated and can interact with one another, ensuring compatibility within the Avalanche ecosystem.

The Avalanche Cryptocurrency (AVAX)

AVAX is the native token of Avalanche. This asset is used to pay fees, stake, and serve as the fundamental unit of account across multiple subnets. The total supply of AVAX is capped at 720 million.

AVAX represents the weight that each node holds in making network decisions. No single participant owns the Avalanche Network, so each validator has a proportional weight in network decisions corresponding to the share of total holdings they possess through proof of stake (PoS).

Any entity attempting to conduct a transaction on the Avalanche network pays the appropriate fee, which is burned and permanently removed from circulation.

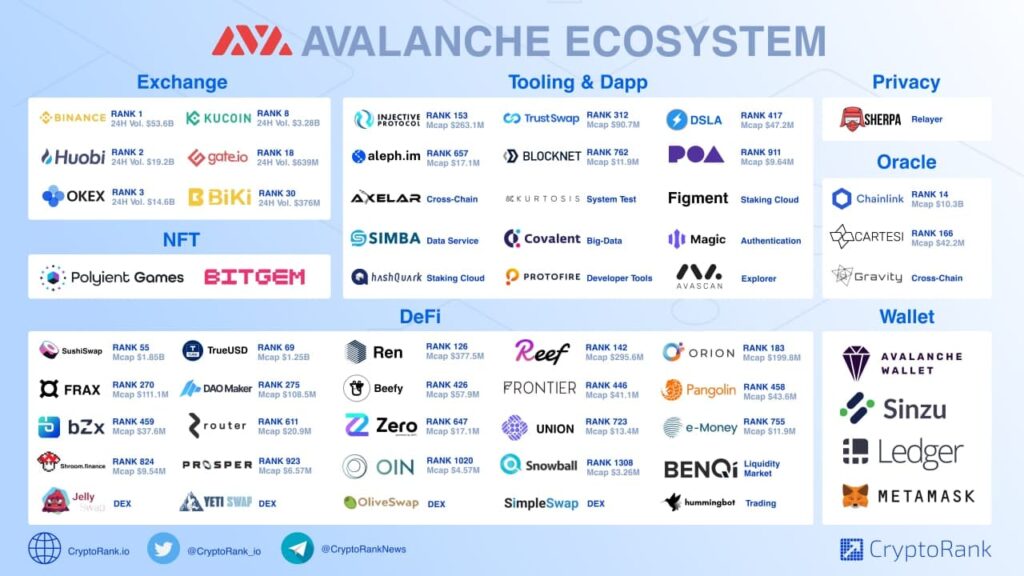

The Avalanche Ecosystem

The Avalanche ecosystem comprises a range of components and other crypto projects.

Advantages and Disadvantages of Avalanche

The project boasts several advantages:

- Limited Supply: The supply of AVAX is capped at 720 million, and the network features a fee-burning mechanism similar to Ethereum, potentially making it a store of value.

- Speed: The blockchain can process up to 4,500 transactions per second, significantly surpassing Ethereum.

- Compatibility: Avalanche allows for data exchange with other blockchains, facilitating efficient interaction.

However, one of the biggest drawbacks of Avalanche is the strong competition from projects like Ethereum, which remains the primary choice for most developers due to its size. Additionally, Avalanche complicates the ability to become a validator with a minimum stake of 2,000 AVAX tokens, which would cost around $33,000 at the time of writing.

It is also important to note that the activities of unreliable validators are not penalized. This means that malicious actors and those who fail to perform their validator duties do not need to worry about financial losses, resulting in a lack of incentive to improve their performance.

Conclusion

Avalanche is an innovative blockchain platform that aims to solve the “blockchain trilemma” by providing a balance between scalability, security, and decentralization. Designed to overcome the limitations of Ethereum regarding transaction speed and cost, Avalanche offers high efficiency and low fees.

Given its extensive ecosystem, investments, and partnerships, Avalanche continues to evolve, striving to secure a significant place in Web3.

FAQ

What distinguishes Avalanche from Ethereum?

Avalanche offers faster transaction processing and lower fees compared to Ethereum.

What is the AVAX cryptocurrency?

AVAX is the native token of Avalanche, used for paying fees, staking, and serving as a unit of account within the ecosystem.

How do I get started with Avalanche?

Visit the official dashboard website and click on “Connect Wallet.” Follow the on-screen instructions to connect wallets like MetaMask, Trust Wallet, and others.